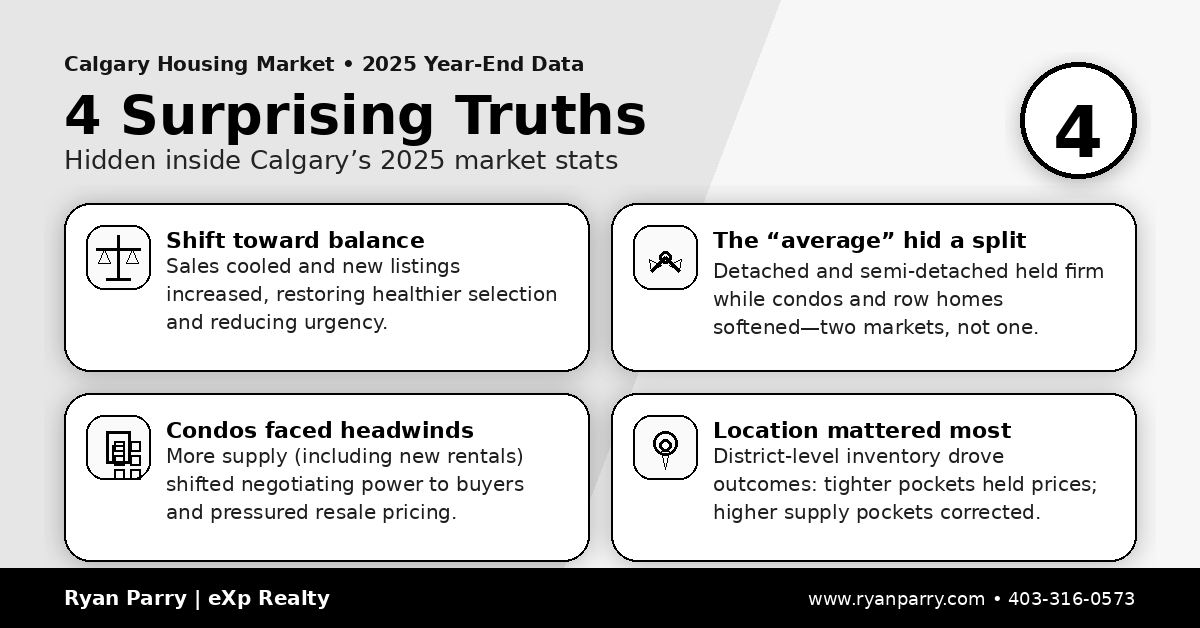

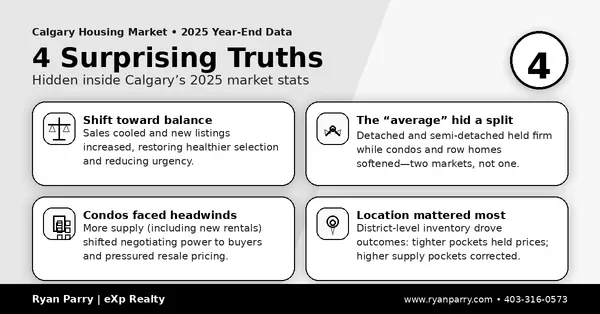

4 Surprising Truths Buried in Calgary's 2025 Housing Market Data After several years of a relentlessly hot real estate market, the common perception is one of continuously escalating prices and fierc

4 Surprising Truths Buried in Calgary's 2025 Housing Market Data

After several years of a relentlessly hot real estate market, the common perception is one of continuously escalating prices and fierce competition. For buyers, sellers, and homeowners alike, this narrative has become the norm.

However, 2025 marked a pivotal "year of transition" for Calgary's housing market. A deeper dive into the 2025 data reveals a fractured market, where the city-wide 'average' was a misleading illusion. Below the surface, different property types and neighbourhoods were living in entirely different realities. This article unpacks four of the most surprising and impactful takeaways buried in the year-end statistics.

1. The Market Finally Took a Breath: A Shift Toward Balance

After years of conditions that heavily favored sellers, the Calgary real estate market shifted toward a more "balanced" state in 2025. This change didn't happen by accident; it was the result of two powerful forces working in tandem to cool the market's recent intensity.

The first force was easing demand, as pressure from buyers lessened due to a reduction in migration levels and heightened uncertainty during the spring market. Total sales for the year reached 22,751 units, a 16 per cent decrease from the previous year. While a notable drop, this sales volume is not a sign of a market collapse; rather, it signals a return to more historically normal levels of activity after several years of unsustainable frenzy. The second force was a significant improvement in supply. Over 40,000 new listings came onto the market—nine per cent higher than last year. This influx caused inventories to rise, giving buyers more options and helping to restore balance.

2. The "Average" Price Drop Hides a Surprising Split

Here’s the biggest contradiction in the 2025 data: while the average benchmark price for all homes fell by two per cent to $577,492, prices for a typical detached house actually rose. This headline number conceals a dramatic split in the market, where prices for different property types moved in completely opposite directions.

What this divergence tells us is critical to understanding the 2025 story:

- Annual detached home prices rose by one per cent.

- Annual semi-detached prices rose by three per cent.

- Conversely, annual apartment prices fell by three per cent and row home prices fell by two per cent.

The explanation lies in the supply surge. The increased availability of apartment and row homes was significant enough to weigh on their prices, effectively offsetting the gains seen in the detached and semi-detached sectors and pulling the city-wide average down.

3. The Apartment Market Faced the Biggest Headwinds

The story of apartment-style homes was unique in 2025, as this sector saw the largest price adjustment. While sales declined by a significant 28 per cent compared to the near-record highs of the previous year, they were still over 28 per cent higher than long-term trends, indicating continued underlying interest in this property type.

The primary cause for the shift was the substantial increase in supply. A rise in apartment-style housing starts, including purpose-built rentals, added to the overall supply choice for residents. This influx of new rental units gave potential first-time buyers more high-quality options, reducing the urgency to purchase a resale condo and shifting negotiating power firmly into their hands. This created a perfect storm for the resale condominium market, which shifted in favor of buyers by the second half of the year and led to persistent downward pressure on prices.

4. Where You Lived Mattered More Than Ever

City-wide statistics don't capture the full picture. In 2025, market conditions varied dramatically between different districts in Calgary, meaning a buyer's or seller's experience was heavily influenced by their specific location.

As Ann-Marie Lurie, CREB®’s Chief Economist, noted:

"Adjustments in both supply and demand varied across the city, with pockets of the market continuing to experience seller’s market conditions versus some areas where the conditions favoured the buyer. This resulted in different price trends based on location, price range and property type.”

This creates a tale of two markets, perfectly illustrating a core real estate principle: in a transitioning market, low inventory will always act as a floor for prices, while a surge of new listings will inevitably lead to price corrections. A clear example of this can be seen in the detached home market. In the City Centre, detached inventory remained well below long-term averages, which contributed to annual price growth of over three per cent. In sharp contrast, the North East and East districts experienced significant gains in inventory, which in turn drove annual price declines of two per cent.

A Final Thought

The key lesson from 2025 is that the era of a single, city-wide market narrative is over. Buyers and sellers must now be far more strategic, paying closer attention to their specific property type and hyper-local district trends than at any point in the last three years. For the first time in three years, the market is heading into a new year with healthier inventory levels.

With more homes finally available, could 2026 be the year that buyers regain the advantage?

Categories

Recent Posts

GET MORE INFORMATION